BOX Messaging Hub

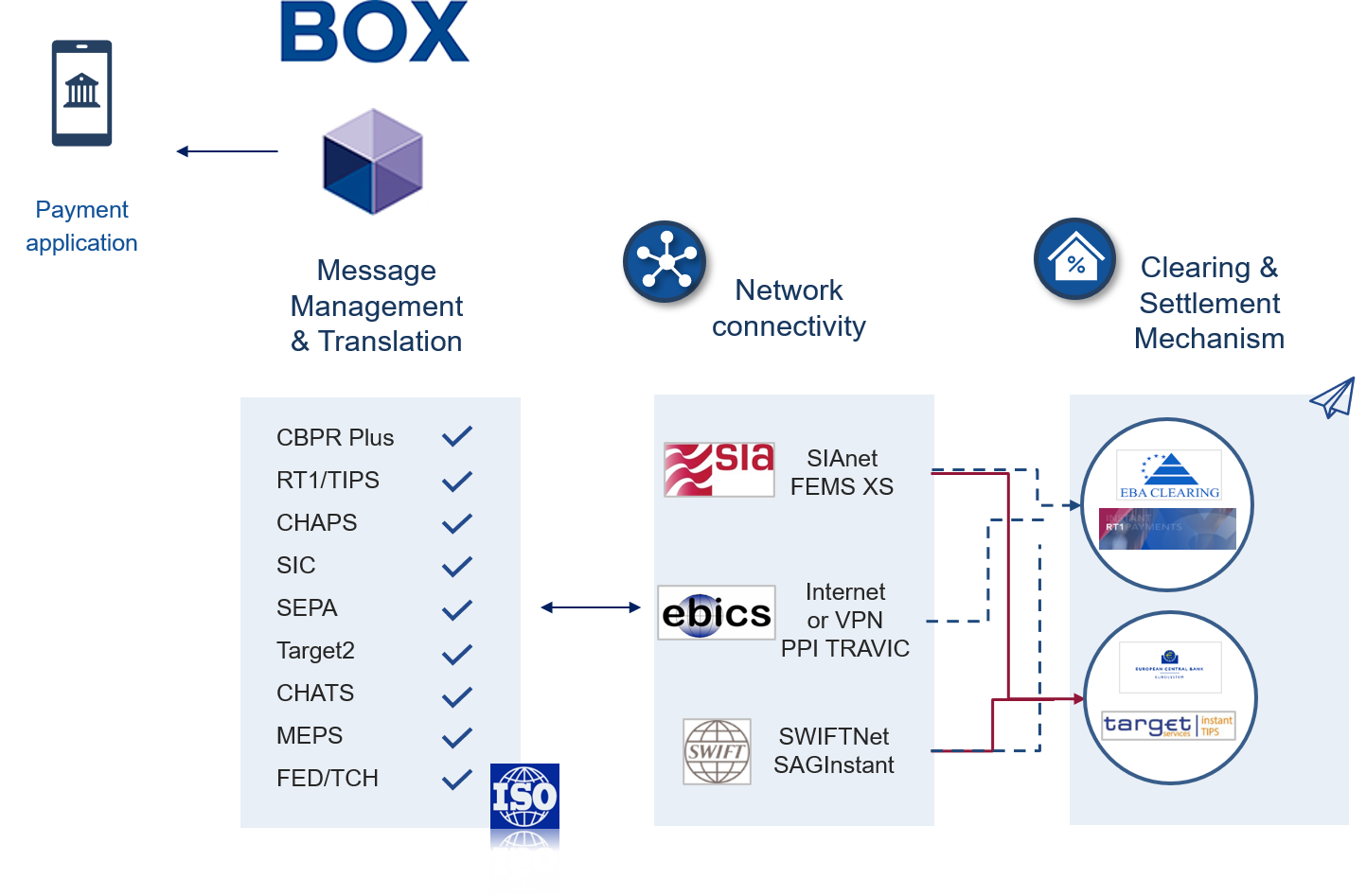

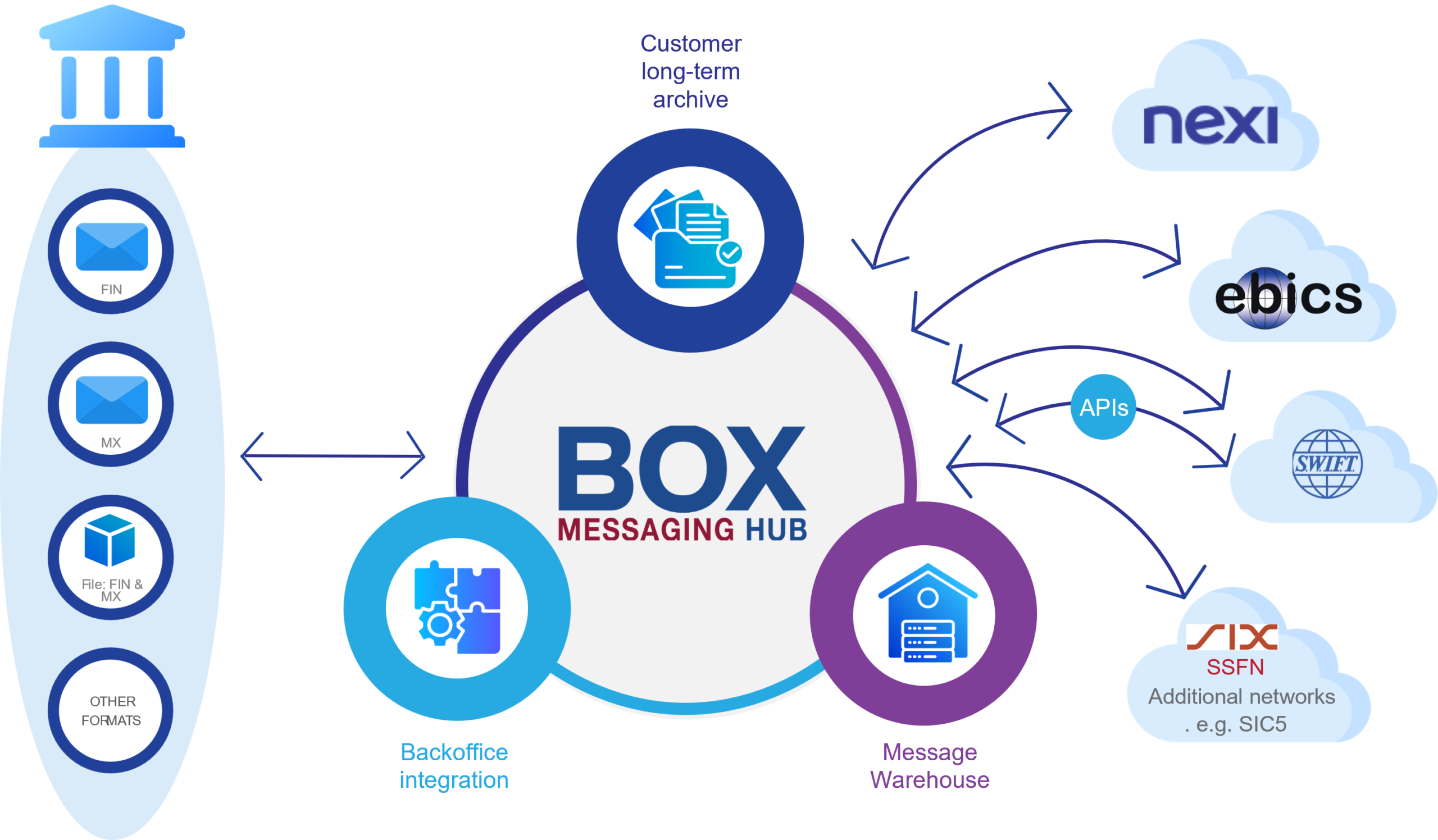

Intercope’s BOX product provides a single window for the financial messaging and gateway requirements of our customers. As well as network and market infrastructure connectivity, BOX has comprehensive functionality for back-office integration, manual message processing, warehouse, and archiving.

Fully integrated with the customer’s choice of infrastructure, the solution is based on a robust and format independent engine. BOX includes a flexible workflow engine for file/message management and orchestration – including routing, exception handling and interoperability with one or more networks and market infrastructures.

BOX supports multiple financial networks (EBICS, SIAnet and SWIFTNet) on the same platform, with further network interfaces implemented based on customer community demand.

BOX is a native ISO 20022 solution and presents the same look-and-feel for either SWIFT FIN, ISO 20022 XML, EBICS and SIA messages. BOX has the complete ISO 7775 / 15022 and 20022 stacks with embedded transformations for SEPA, TARGET2, CBPR+, CHAPS, MEPS, CHATS and all migrating schemes stored and managed in the Message Warehouse. BOX provides monitoring, reporting and real-time dashboards of all activities for full view and control.

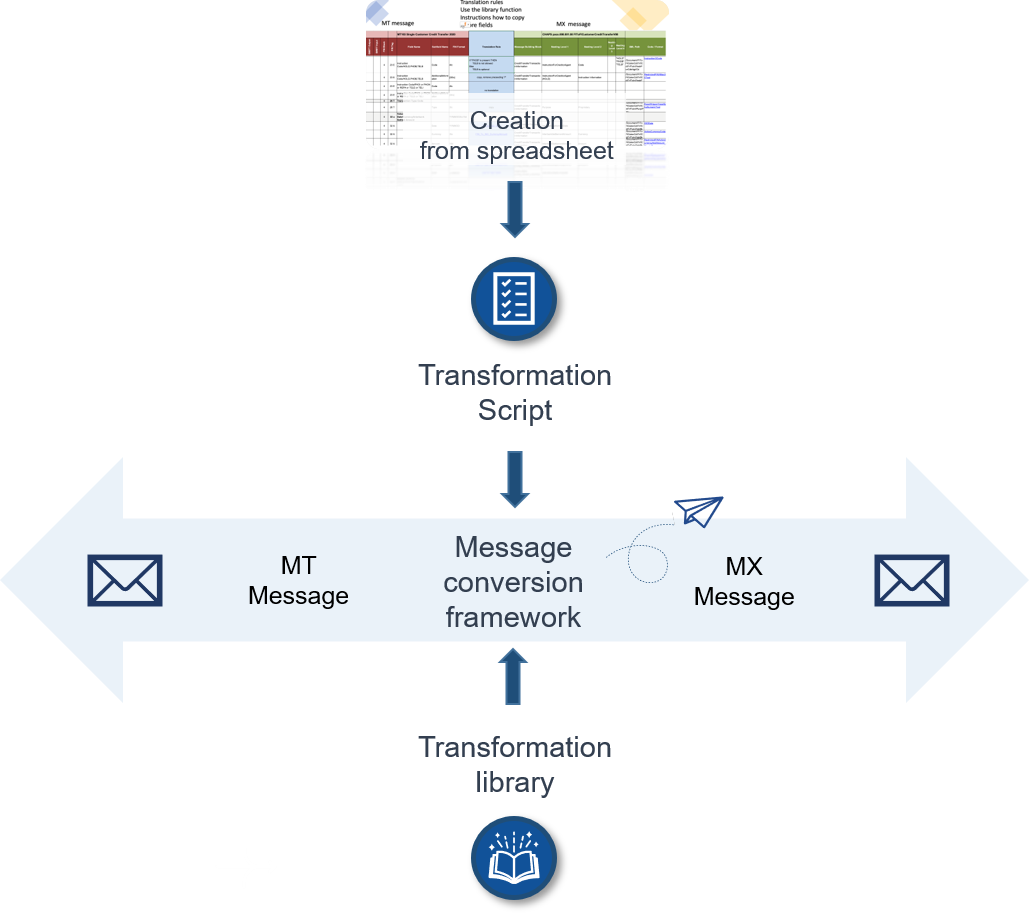

Conversion of industry files/messages to/from proprietary and legacy formats in BOX allows customers to shield their back-office applications from SWIFT and market infrastructure scheme changes. This is managed through new GUI driven configuration. Complete message and file validation (syntax, semantics, cross-field) is provided as well as bi-directional conversion for SWIFT MT / MX messages per schemes managed and maintained by Intercope.

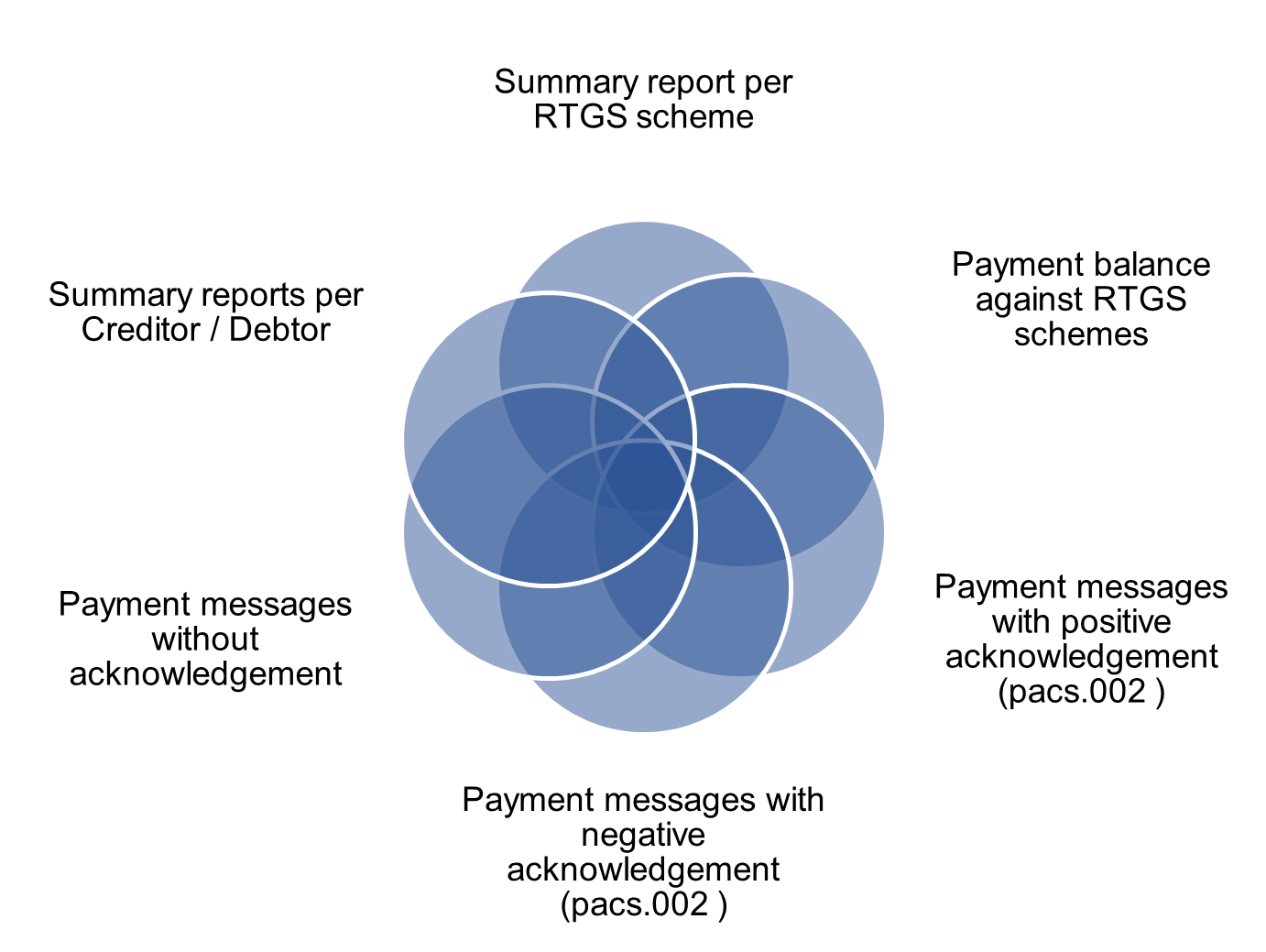

BOX provides manual and automated message processing, error handling, with comprehensive workflow and routing. The new BOX payments message warehouse with archiving provides a full view of all data activities in/out of the bank, co-existence of all new (ISO 20022) and old scheme messages, side by side, with any truncated data. This provides full overview for all reconciliation activities for individual scheme and cross border payments, and very importantly a single source for regulation reporting.

A unique to the market multi-network solution. BOX supports multiple financial networks (EBICS, SIAnet and SWIFTNet) on the same platform. Protocol specific functions are implemented in dedicated interfaces and decoupled from the rest of the application, allowing connections to further networks without changing the Messaging server core. BOX supports the concurrent use of these multiple financial networks on the one instance. BOX customers can uniquely decide which market infrastructure to best use for business decisions and not just based on technology and network limitations. This protects and regulates BOX customers for Systemically Important Payments Systems (SIPS) oversight requirements by removing all single points of failure – future proofing against increased regulation.

Hover over the numbers to find out more!